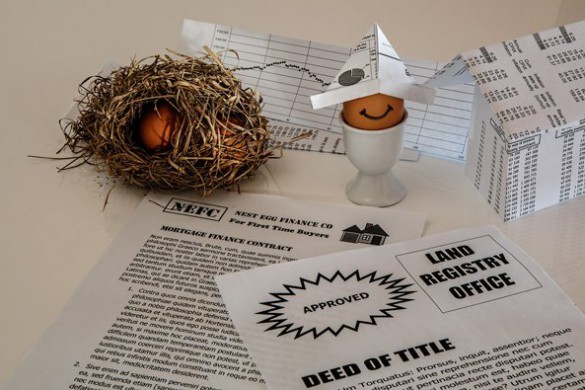

The last few years have been unstable times for investors. Unlike the U.S. and other countries, the Canadian housing sector held steady and has been encountering quality through 2014.

Record home deals in the first quarter of 2014, are thought to be because of a combination of factors. Increased demand, low supply levels and truly low Canadian mortgage rates were a strong blend of business drivers. As the housing business gets to be more adjusted, with additionally housing supply getting to be accessible, costs ought to balance out and develop at a much slower rate.

What does the future hold in store for the Canadian housing business sector?

Home costs are not anticipated that will increase as much as they did in the first portion of 2014. Accordingly, purchasers may find that the more sensible posting costs, coupled with less purchasers hurrying into make offers or various offers, will mean better esteem for their real estate dollar. The slight increase in mortgage rates throughout the second portion of the year ought not influence the affordability, if cash was spared purchasing the home.

Despite the fact that it is difficult to precisely foresee what will happen with the Canadian economy and premium rates, the general agreement among all the major banks is that variable and altered premium rates will climb through the following 19 months. The overnight rate will climb is a matter of argument and obviously, these are just forecasts and can change. The pace and quality of the financial recovery, alongside worldwide elements, will impact giving rates and fiscal arrangement.

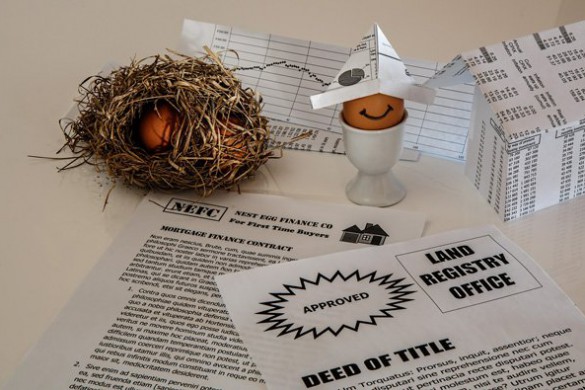

At whatever point, the time is a good fit for you to purchase, picking the right bank can spare you thousands over the term of your mortgage. Pick a qualified mortgage agent who can shop your mortgage over numerous lenders to spare you cash and discover the best mortgage rate in Canada.

In the event that you have a choice to buy your home or refinance your mortgage it is best to manage an agent. A representative will have admittance to huge banks furthermore have admittance to neighborhood merchants. There is a great deal of the profits in utilizing mortgage dealers to buy your home. A mortgage agent is mindful of the whole mortgage industry, including current rates and having contacts with numerous money lenders.

Each one mortgage agent has his own claim to fame; some can get just conventional mortgages a few merchants can get unprecedented advance like reverse Canadian mortgage rates. Canada has numerous expert specialists prepared to help the house seekers. The real advantage of working with a mortgage dealer is that once he comprehends your specific needs he has a decent thought of your financial history, he will have the capacity to recommend which banks may be capable and keen on helping you to get your mortgage. Require significant investment in research for the great Canadian mortgage merchant to discover a decent home and rates for you.