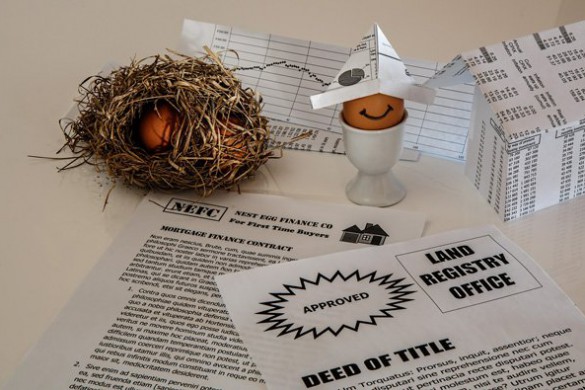

The moment you decide to buy a house, we start looking out for mortgage processing firms and all of a sudden mortgage underwriting services becomes the need of the hour. The lender ,starts gathering as much information as possible to get the loan approved. However it is not as easy as it sounds , for the reason being that a lot of paper work/ document processing is carried out. And even though the lender does the best they can there still some unidentified facts concealed about the process. Lets uncover them and find what are these facts about mortgage processing and specifically about, mortgage underwriting services.

- There is whole team of professionals handling the loan request which includes, Loan officer, Loan processor, Real Estate agent, Mortgage underwriter, Home Inspector and closing representative. The one person who verifies all documents and is responsible for the approval or denial of your loan request is called Mortgage Underwriter.

- Some of the specialized services included in Mortgage Underwriting Services are; verifying through automated underwriting systems, clearing off the loan conditions, performing title reviews and drafting reports, making sure of ways to prevent fraud.

- This service can also be outsourced by financial firms and banks ensuring smooth, effective scrutiny, improved quality work and quicker approvals with better credit decisions.

- Capacity, Credit and Collateral are the 3 Cs of Mortgage Underwriting Services. Capacity to pay off the debts, credit to make sure that the credit history is well managed and collateral to verify the property value and the loan amount to be sanctioned matches.

- Some more factors that add to the list of the eligibility criteria are:borrower’s background verification, borrowing habits, and that the documentation and requirement comply with the laws against money laundering. A verification of the guarantors, is also practiced at times. Mortgage insurance is viewed as a risk mitigation strategy; however it does not replace the Mortgage Underwriting Services.

Although there is no second feeling to owning a home which in itself is an exciting experience, and the roles of borrowers as well as lenders is equally important. A little miss on either part can make it into a nightmare and one of the most challenging tasks of your life. The best step forward would be to always keep the documentation up-to-date and reasonable credit score and rest assured that the decision of mortgage underwriter will be in your favor.

The companies that outsource Mortgage Underwriting Services no doubt offer work done with less hassles in loan approval; however, the borrower need to have a comparison chart for companies offering loan with cost, services and underwriting standards as factors of comparison. One such reliable outsourcing partner is SLKGlobal that has a track record of carrying out efficient underwriting services while taking active steps to increase profits for the company and keep fraudulent activities always under surveillance.

Visit our website to know more, http://www.slkglobalbpo.com