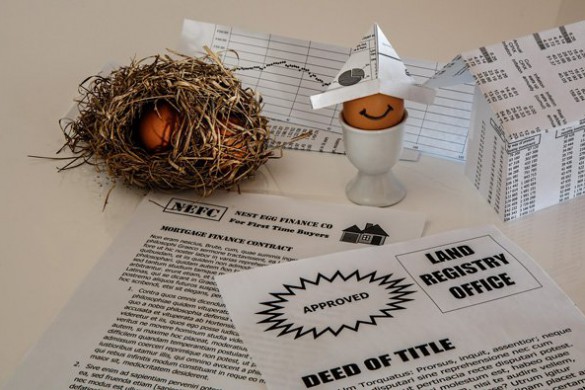

Obtaining the right finance for your home and other needs can be tricky, with multiple players in the market each wanting to lend money at different interest rates. Making use of the brokers that have expertise in the field is a better option as not only are they able to find better interest rates for you but also suggest the best possible solution for your particular situation. Everyone does not have the same credit score neither are all mortgage conditions similar. Making the right choice will make the difference of thousands of dollars in terms of interest.

Refinancing your mortgage

Apart from the primary mortgage, there are several other solutions in the market that the mortgage broker Brampton will be able to tell you about that you may not be aware of. Today the interest rates have dipped more than ever in history and options like the mortgage refinancing is one solution that such a broker will be able to find for you. The refinancing will rework your mortgage amount, the rate of interest and also the amount that you have to pay monthly.

The second mortgage solution

There are also second mortgage solutions that the experienced second mortgage Mississauga may suggest you that will help you in obtaining the second amount independent of the first mortgage and the amount that is due. It is the same home that is held as the collateral in case of the second mortgage, and the interest rate is slightly higher. Having good credit scores are helpful as they can lower the interest rates. This kind of mortgage is useful when there are house repairs and other expensed to meet or even when you wish to buy another property for yourself or even multiple ones when engaged in the real estate business.

The reverse mortgage finance

There is yet another mortgage option that is exclusively reserved for the elderly citizens that own a house.This is the reverse mortgage where the financial institute pays you a onetime amount or monthly amounts against your home. This is especially helpful in getting the necessary finance for health and other living expenses while you retain the title and the ownership of your house. This isa loan that is given that can be paid off later, and you are entitled to it even if you sell of the house.

Your partner in finance matters

The seasoned local brokers are expected to have necessary links and also information about all kinds of development in the financial sector that enables them to be in a better position to advise you on your financial solutions. The other advantage of working through the brokers is that they will take care of all your paperwork, and you can continue with your commitments. This way you save time as well as money with the brokers.